Bridge Loan - Lending Tasks

A Bridge loan is a short-term secured loan (also called as Gap Financing).It is usually applied for short term (12 months) purposes like fund purchase of a new property (mortgage loan) or renovate a new property or renovate an existing property,etc.

Business Scenarios:

For a Bridge loan,depending on the answer chosen during the Origination application submission the mentioned business scenarios ,business use case and the connected loan section display in the assist.The dependency rules get triggered during execution of each task and the collaterals get created/updated in the transact.

Below are the four business scenarios and business use cases of Bridge loan (refer attached excel for more details).

- Scenario -1: Customer already having Mortgage Loan (in same bank) and now seeking BL for the same Property used for Mortgage Loan.

- Scenario -2: Customer applying Mortgage Loan and also seeking BL in the same application- using two different Properties (This is ideally a Bundled Loan).

- Scenario -2A: Customer First applied Mortgage Loan (In-Progress) and subsequently seeking BL - using another Property.

- Scenario-2B: Customer First applied Mortgage Loan (Completed) and subsequently seeking BL - using another Property.

- Scenario- 3: Customer applying for a BL (Standalone BL) using a Property (There is a Mortgage Loan with external Bank on this Property - Second Charge).

- Scenario- 4: Customer applying for a BL (Standalone BL) using a Property (There is NO Mortgage Loan against this property in any Bank - First Charge).

Click here for details regarding Bridge Loan Flow in Origination (Pre-Submission).

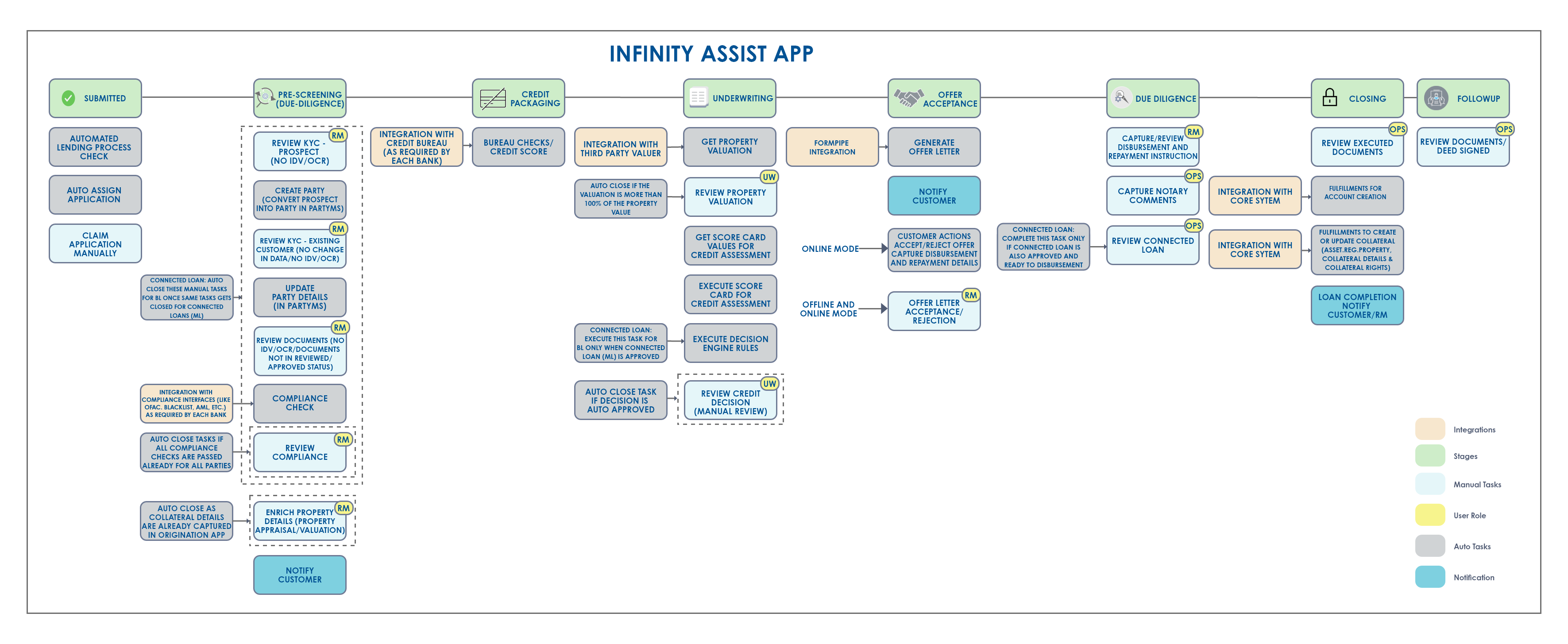

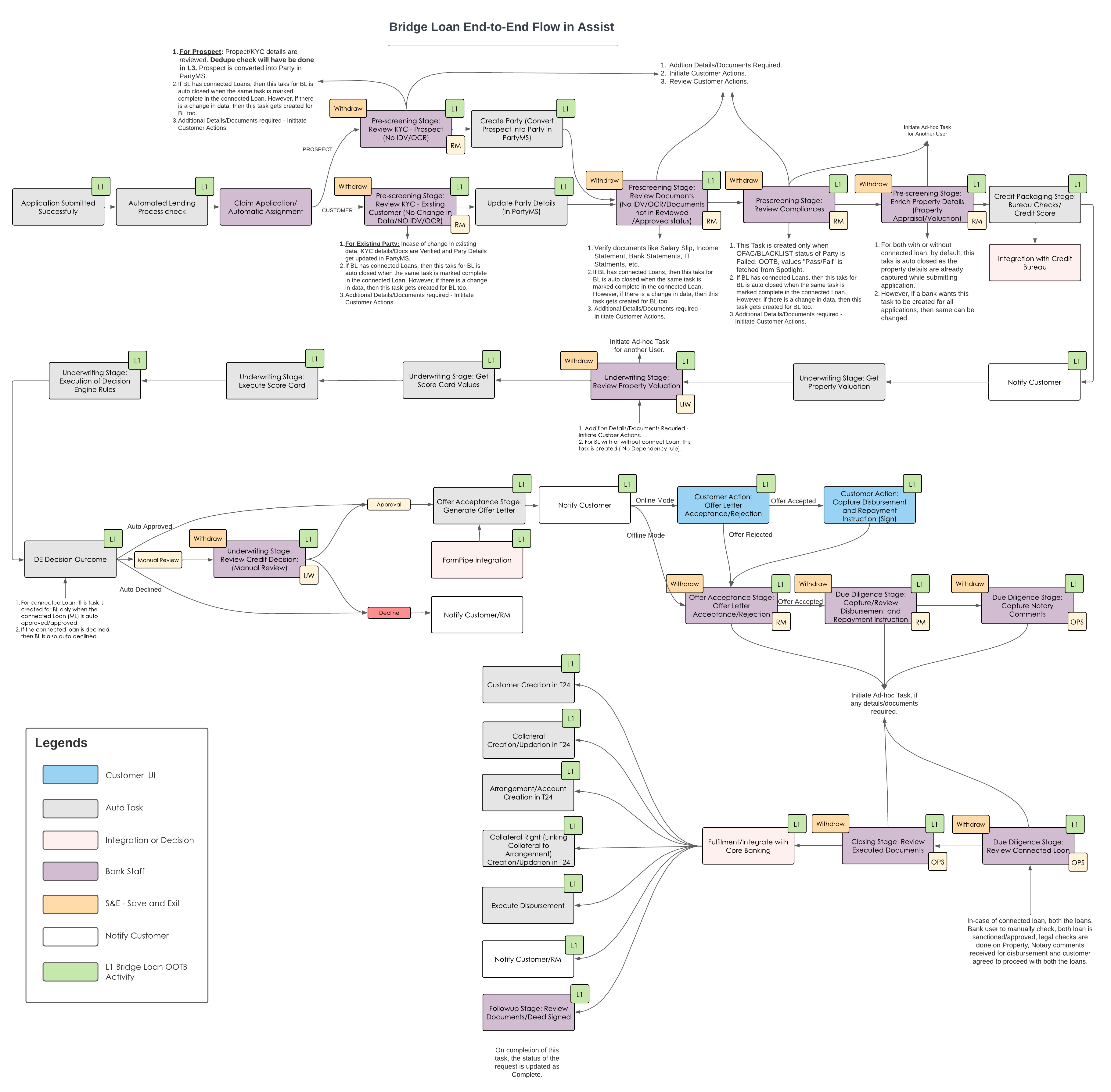

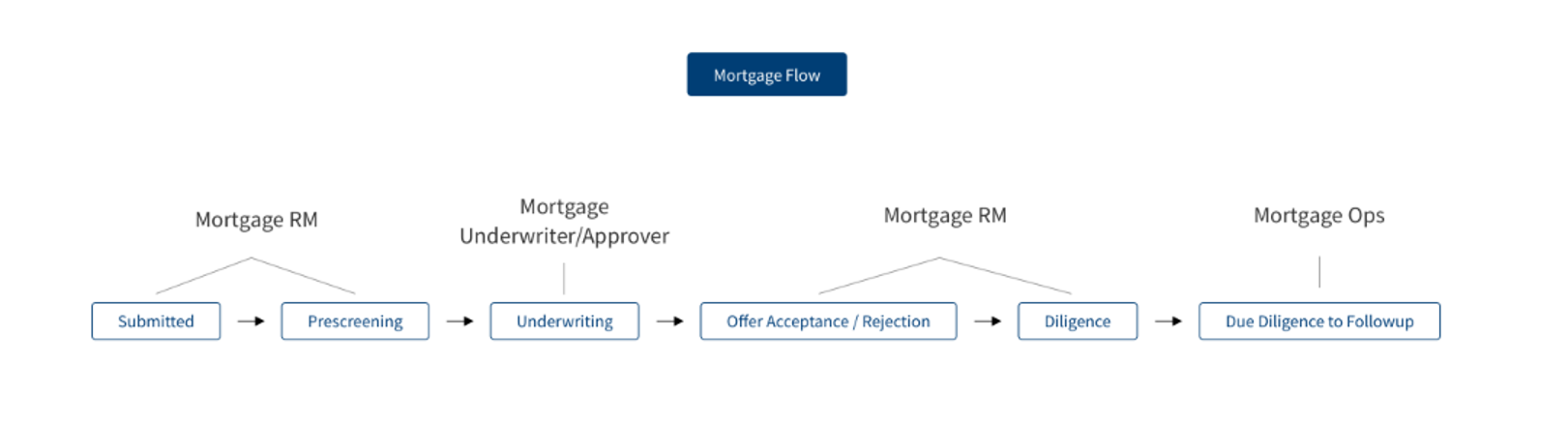

Below is the vertical flow of Bridge Loan - Lending Tasks.

Bridge Loan end-to-end flow in Assist (Sequential Flow)

Post Submission stages

- Submitted

- Prescreening

- Credit Packaging

- Underwriting

- Offer Acceptance

- Due-Diligence

- Closing

- Follow-up

- Default User: Relationship Manager (RM) is the default user.

- Name of Party: All Entity related tasks will have the Entity Name and Product related tasks will have the Product Name.

Tasks created in each of the stages and the effect on the workflow

Submitted

Automated Lending Process Check (Check STP Rules):This is an Auto Task.

Once the Application is submitted in the Origination app, the application enters the Temenos Digital Assist app, where the STP rules is first evaluated by the system for all the submitted application data copied from the ODMS to OPMS. The Assist app runs the following rules:

- STP Rule 1: Check if the application is initiated by an existing customer (application should not have any prospect applicant/co-applicant).

- STP Rule 2: If it is an existing customer and there is NO change in the customer data acquired from the partyMS.

If the result of the above two rules is “Yes”,the application is marked as STP - yes and auto claimed. It is assigned to the supervisor user and moved to the next stage "Pre-screening".

If the result of either or both the above two rules is “No”, the application is marked as STP - No.

Check STP Rules - Fields to be checked: For a system with or without connected Loan (No Dependency rule), if the STP rule 1 is validated and updated as “yes” and while the STP rule 2 is being validated, the following fields need to be checked for an existing customer to see if there is no change in the data acquired from the PartyMS:

KYC Information:

- First Name

- Last Name

- Date of Birth

- Email Address

- Country Code

- Phone Number

- Tax ID No

- Identity Type

- Identity Number

- Issued Country

- Issued State

- Issued Date

- Expiry Date

- Address Line 1

- Address Line 2

- City

- State

- Zip Code

Financial and Employment

Occupation Details:

- Status

- Occupation

Income Information:

- Income Period

- Total Gross Income Per Month (Optional)

- Total Net Income Per Month

- Other Income (Optional)

Expense Details:

- Total Monthly Loan Repayment

- Total Monthly Household Expenses

Assets:

- Total Asset

Liabilities:

- Total Liabilities

Employment Details:(should have multiple records if there are more than one employment detail)

- Organization Name

- Employment Start Date

- Employment End Date (NA, if I currently work here option is checked)

- I currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

- Phone Number

Business Details: (should have multiple records if there are more than one business detail)

- Organization Name

- Business Start Date

- Business End Date (NA, if I currently work here option is checked)

- I currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

- Phone Number

Move Application to My Request:

Rule:The system evaluates the STP rules - if the result is N and auto assignment rule pass.

The system checks if the result is No for either of the STP rules and the auto assignment rule is configured and passed, then the application automatically gets assigned to the respective user.This is an auto task executed by the system.The application displays in the respective user’s “My Request” as per the assignment rule.

Move Application to Application Queue Automatically:

Rule:The system evaluates the STP rules - if the result is N and auto assignment rule fails.

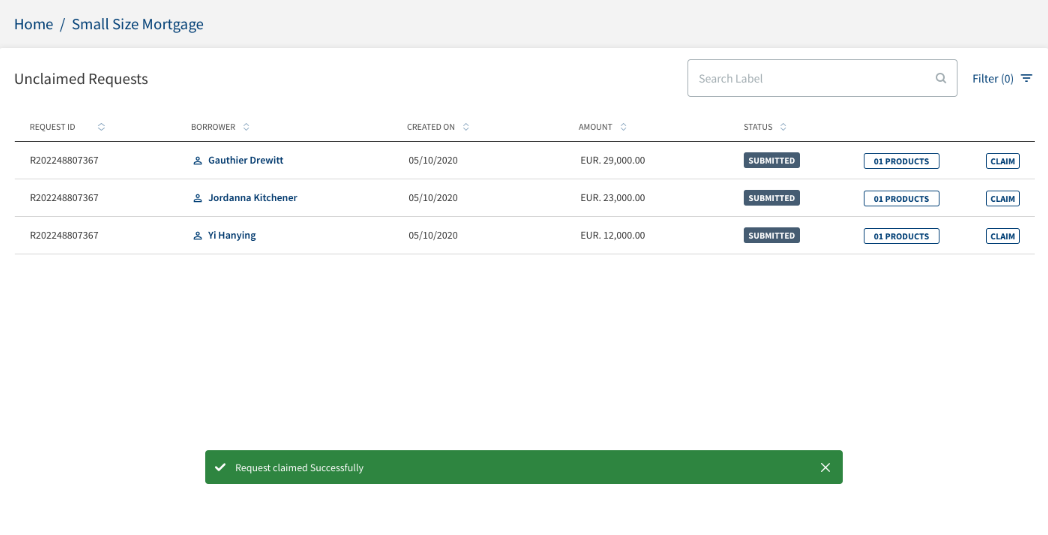

The system checks if the result is No for either of the STP rules and the auto assignment rule is not configured and failed, then the application is routed to the respective queue.This is an auto task executed by the system.The application is moved to the respective queues depending on the loan amount.The RM claims the application from the "My Queue” as per the user permissions.

The Bridge Loan Request /application is auto mapped to the respective queues depending on the loan amount. These queues are applicable only for Bridge loans:

The mapping is as follows:

- Retail_Small Size Bridge loan:

- This queue is for small ticket Bridge loans

- Loan Amount range >0 and <=50,000

- Retail_Medium Size Bridge:

- This queue is for medium ticket Bridge loans

- Loan Amount range >50,000 and <=100,000

- Retail_Large Size Mortgage:

- This queue is for large ticket Bridge loans

- Loan Amount range >100,000

The loan amount threshold is configurable and the range is editable as per every bank policy.

Rule: Auto assignment rules failed, check loan amount and assign the BL application to respective queue.

Claim Application: The RM user claims the applications/task when automatic assignment rules fails or disabled that are pushed to the queue for manual processing of capturing and reviewing the customer details. This is a manual task to be processed by the respective user (The application is claimed only if the application is moved to queue to be claimed manually).

Once a RM user claims the application/task when automatic assignment rules fails or disabled, it moves into the respective user's My Task.

Rule: User clicks on the claim application and the application is assigned to the respective user.

This functionality of the claim application is applicable to all the manual queues whenever the user clicks on the claim application.

Prescreening

Create Party in Party MS: The System checks the following scenarios to update the party details.This is an auto task executed by the system.

A new Party is created in Party MS for the prospect with status Active. Customer (Customer ID) is created in the Transact. Once the KYC details are reviewed for all prospect Parties, the Party ID is created for all the parties (borrower and co-borrower).

Rules:

- When a Review KYC -Prospect task is completed, the Party is created in PartyMS.

- Dependency Rule: If the BL has connected Loans, this task does not get created and gets auto closed directly.If the same task is complete in the connected Loan,the party ID is copied from the same task of the connected Loan.

If the Bridge Loan has NO connected Loans, this auto task is created independently and the party Id is created in the Party MS.

Review KYC-Prospect:This is a manual task that gets created if there is a new party (prospect) in an application. The task is run for all parties in the application.

Dependency Rule: If the Bridge Loan has connected Loans,this task does not get created and is auto closed directly when the same task is marked complete in the connected Loan. However, when there is change in the Personal, Address & ID and Financial data (i.e., the data prefilled from connected loan application is modified by the customer while submitting the application),this task is created.

If the Bridge Loan has NO connected Loan,this manual task is created independently and assigned to the RM user.

This Task is created when the application has a Prospect applicant and Prospect data/document is to be reviewed by the Bank user. The RM user Reviews, Validates KYC and other information along with the documents submitted by the Prospect. This is a manual task which is processed by the respective user.

If the application is submitted by the customer and the applicant is an existing customer then the Review KYC Prospect task gets closed automatically.

The task runs all the prospect parties in the application. The task is in the Pre-screening Tasks queue under My Queue . The RM user views the task under My Task after claiming the task. When user clicks the task it navigates to the Entity Overview section. Once the user completes the task, the status is marked as Complete and the next task in the workflow gets created. The same set of fields that are given as part of this task Check STP Rules - Fields to be checked is reviewed / checked by the RM.

- In the Collateral Section, if an existing collateral is used for the Bridge Loan, a new collateral is not created rather the existing collateral selected by the user in the Origination App displays.

- It displays the previous Mortgage loan linked to this collateral in the Applied Products section along with Bridge Loan that is being applied. It also displays the outstanding loan of the existing Mortgage Loan and the First/Second Charge.

Rule: This task is created if there is a new party (prospect) in Review KYC - Existing Customer details.

Review KYC - Existing Customer Task:The below rules are applicable for this task when created for a Bridge Loan.

Rules:

- The manual task is created if there is an existing party in the application and change in the KYC Information data or if the status of Proof of Identity, Proof of Address and Proof of Income and Supporting Financial documents are not Approved. The task is applicable for all the existing parties in the application.

- This task gets auto closed if the customer details are verified through OCR/IDV.

- Dependency Rule: If the Bridge Loan has connected Loans,this task does not get created and is auto closed directly when the same task is marked complete in the connected Loan. However, when there is change in the Personal, Address & ID and Financial data (i.e., the data prefilled from connected loan application is modified by the customer while submitting the application),this task is created.

If the Bridge Loan has NO connected Loan,this manual task is created independently and assigned to the RM user.

The system checks if the applicants are existing customers and the status of proof of identity,proof of income documents are approved. If the applicants are existing customers and the status of proof of identity ,proof of income and supporting financial documents are approved, the task gets closed automatically. This is applicable for all the lending journeys.

- In the Collateral Section, if an existing collateral is used for the Bridge Loan, a new collateral is not created rather the existing collateral selected by the user in the Origination App displays.

- It displays the previous Mortgage loan linked to this collateral in the Applied Products section along with Bridge Loan that is being applied. It also displays the outstanding loan of the existing Mortgage Loan and the First/Second Charge.

Update Party in Party MS:The System checks the following scenarios to update the party details. This is an auto task executed by the system.

The Party details get updated to the existing party ID in the Party MS. Update party for all the existing party in the application (borrower & co-borrowers).

Rule:

- Dependency Rule: If the Bridge Loan has connected Loans,this task does not get created and is auto closed directly when the same task is marked complete in the connected Loan.The party ID is copied from the same task of the connected loan.

- When a Review KYC - Existing customer task gets completed, the task is created and the changed party details is updated in the PartyMS.

If the Bridge Loan has NO connected Loan,this manual task is created independently and the party details is updated in the PartyMS.

Once the task is completed, the application moves to the next task Review Documents.

Review Documents: This task is created to review the income documents uploaded by the customer. All the Income documents (Financial information related documents) submitted in the Origination app is shown in the Entity Overview with status as Pending/Approved.

The User can view all the income documents.

The RM reviews the loan application documents if the task is created. If there are any changes to the financial information or the status of the document category-Income Documents is Pending the task is created.

This is a manual task processed by the respective user who can view the application under My Task when the task is claimed. When the task is clicked it navigates to the Document section under Entity Overview.

If the document status is Pending / Approved for the document category Income Documents, this is auto closed. This rule is added as Income documents are validated as part of the KYC Review task itself, to reduce the number of Manual tasks in the OOTB, we are auto closing this task. However if the Bank wants this task, to be auto-closed only when the uploaded document status is Approved, then this rule can be accordingly modified.

When customer submits the application and when there is change in Financial information data and status of Proof of Income documents are NOT Approved, then Review task is created and assigned to the RM. RM can raise Customer Action if any data or document is required from the customer. After the Customer Action is complete, RM reviews the Customer Action and manually closes the task.

Financial Information

- Status

- Occupation

- Income Period

- Total Gross Income Per Month (Optional)

- Total Net Income Per Month

- Other Income (Optional)

- Total Monthly Loan Repayment

- Total Monthly Household Expenses

- Total Asset

- Total Liabilities

Employment Details :

- Organization Name

- Employment Start Date

- Employment End Date (NA if "I currently work here" is checked)

- I Currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

- Phone Number

Business Details

- Organization Name

- Business Start Date

- Business End Date (NA if "I currently work here" is checked)

- I currently work here Address Line 1

- Address Line 2

- Country

- State

- City

- Zip

- Code

- Country

Documents: In the below category the status should be other than approved.

- Proof of Income

Rule:

- This Manual task created if the financial Information data is changed.

- If there are NO changes to the financial information, the task gets auto closed.

- If there are changes in the financial Information fields, the task gets created.

- Check if the status of the document category - Income Document, is Pending.

- If the status is Pending - this task is created.

- If the status is Approved - this task is auto closed.

- Dependency Rule: If the Bridge Loan has connected Loans,this task does not get created and is auto closed directly when the same task is marked complete in the connected Loan. However, when there is change in the Personal, Address & ID and Financial data (i.e., the data prefilled from connected loan application is modified by the customer while submitting the application) which this leads to upload of new documents and status of the document is pending,this task is created.

If the Bridge Loan has NOconnected loans, this manual task is created independently and assigned to the RM user.

Once the user completes the activities, the task is marked as completed, the application moves to the next task OFAC Check & Blacklist Check.

OFAC Check and Black List Check: The below rules are applicable for this task when created for a Bridge Loan.

Rules:

- This auto task is created to acquire the OFAC or Blacklist data - Pass/Fail from the Spotlight configuration.

- Dependency Rule: If the BL has connected loans, this task is not created and the OFAC and Blacklist data received from the connected loan is used and auto closed.

Once the OFAC and Blacklist data is acquired, this auto task is marked as complete.

- If the results is fail for any of the OFAC or Blacklist list check,the next task “Review Compliance” gets created in the workflow.

- If the results is Pass for both of the OFAC or Blacklist list check, the application completes this task and moves to next task.

Review Compliance task: The below rules are applicable for this task when created for a Bridge Loan.

Rule:

- This auto task gets created if the compliance status fails for one or more compliances for that party/prospect.

- Dependency Rule: If the BL has connected loans, this task does not get created.The OFAC and Blacklist data received from the connected loan is used and auto closed.

If the Bridge Loan has NOconnected loans, this manual task is created independently and assigned to the RM user.

The user views the Review compliances task if the compliance status fails for one or more prospect/party.The user navigates to the Request Overview (Request Overview >Monitoring >Compliances) by clicking this task.

Once the user completes the activities, the task is marked as completed. The application moves to the next task Enrich Property Details.

Enrich Property Details: The below rules are applicable for this task when created for a Bridge Loan.

Rule:

- This manual task is auto closed by default.It is created only if enabled by the bank to capture additional property details.

- No Dependency Rule: The above rule is applicable irrespective of a Bridge Loan having connected loans or not.

As part of this task, the Property details can be captured/enriched. Once the compliance details are checked, the RM updates the property details if not captured. This is a manual task to be processed by the respective user.

This task gets auto closed if the flag Have you identified the Property = Yes.

This task gets auto closed if the flag “Have you identified the Property” = Yes or if all the Compliance results is Fail. Since the user has to mandatorily enter property details while submitting the application, by default this task gets auto-closed. However in future release, if the user chooses to skip entering the Property details while submitting the application, Then this task will be created and the user can capture the property details as part of this task.

If it is No, the task is initiated and the user (RM) captures the property information. The task is in the Mortgage Pre-screening Tasks queue. Clicking the task navigates to the Collateral Section of the Entity Overview.

Rule: Check if the property details are captured.

Once the user completes the activities, the task is marked as completed. The application moves to the next task Notification to Customer.

If Have you identified the Property field is No and if all the compliance results are Pass or Partially Pass, then Enrich Property details task is created.

- In the Collateral Section, if an existing collateral is used for the Bridge Loan, a new collateral is not created rather the existing collateral selected by the user in the Origination App displays.

- It displays the previous Mortgage loan linked to this collateral in the Applied Products section along with Bridge Loan that is being applied. It also displays the outstanding loan of the existing Mortgage Loan and the First/Second Charge.

Notification to customer: The System triggers a notification to the customer based on the configured event. This is an auto task executed by the system.

Rule: Once the enrich property details task is closed, the system triggers a notification to the customer indicating the status of the application.

No Dependency Rule: The above rule is applicable irrespective of a Bridge Loan having connected loans or not.

The system triggers a notification to the customer once the enrich property details task gets closed.

If the Customer details are updated, OFAC/Blacklist check is pass, then the property details are updated and the task is closed and the Notification gets triggered. Once the task gets completed, the application moves to the next Stage and triggers to check next task Business Bureau Check.

Notification Template:

Dear <Entity Name> (Display Entity name of Primary Applicant/Co-Applicant as per the entity to whom the mail is sent)

We are evaluating your application now, and will get back to you within 5-7 business days with an update on next steps.

Regards,

Temenos Digital Bank.

Credit Packaging

Review Financials :The Bank user reviews the financial details of the applicants in this task.This is a mandatory manual task for First Time Buyer, Re-mortgage and Bridge Loan Journey.

Business Bureau Check: The below rules are applicable for this task when created for a Bridge Loan.

Rule:

- When application moves to the Credit Packaging stage, this auto task is created to acquire the configured default bureau score data for each party in the application.

- Dependency Rule: If the BL has connected loans, this task does not get created and the data received from the connected loan is used and auto closed.

When the BL has no connected loan the system fetches the bureau check score data once the pre-screening tasks get complete and the application is moved to the Credit Packaging stage. If the BL has connected loans, this task does not get created and the data received from the connected loan is used and auto closed. This is an auto task executed by the system and gets auto closed, it displays a default value in the credit score field.

Underwriting

For more details regarding Mortgage Approval In-Principle please refer to the link.

Review Bureau Score: On receipt of the Bureau check results, the system triggers a Review Bureau Score task (part of underwriting stage), when the value of the bureau score is less than X whose value can be configured in Spotlight.

- The system triggers the task only when the value of the bureau score is less than X value (Bureau Score < “X“ Value)

- The system does not trigger the task when the bureau score is greater or equal to X value (Bureau Score >= “X“ Value) however it proceeds to the next task i.e. Generate Approval In- Principle and Illustrative ESIS task.

- The RM can claim the task from the Mortgage Processing Tasks queue.

- The system navigates to the Product overview when the RM clicks the Product ID in the task.

- Case 1: If the RM decides to proceed with the application after reviewing the bureau score of the customer and adding an appropriate narrative by completing this task, the system navigates to Generate Approval In-Principle and Illustrative ESIS task.

- Case 2: If the RM decides not to proceed with the application after reviewing the bureau score of the customer, the RM can withdraw the application.

OOTB “X” value is 700

- The system triggers the task only if it is <700.

- If the value is >700 it gets auto approved.

- If its between <400 it gets auto rejected and this value of X is configurable.

Review Credit Bureau Score :The system auto closes the Review Credit Bureau Score task when the Credit Bureau score is > “700”, where “700” is configurable. If all the compliance results fail , the task gets auto closed.

- The RM can add narrative and change the acceptance status.

- If the valuation (value under Collateral > Documents > Valuation > Field: Value) is less than 100% of the “current property value”, this task is created.

- If the valuation is equal to or more than 100% of the “current property value”,this task gets auto closed.

Get Property Valuation:The actual property valuation is initiated after the Review Remortgage details task. A valuation for the property is done to know the exact property cost.Integration with 3rd party valuators provides the actual property valuation report and this is taken from the spotlight.This value is updated in General- edit collateral documents in the valuation tab under value.

For a BL with or without connected Loan (No Dependency rule), once application reaches the Underwriting stage, “Get Property Valuation” task is created. In this task depending on the spotlight configuration for the property valuation, the system calculates the valuation of collateral (Spotlight configuration % * Current property Value) for Bridge Loan.

Eg: If the spotlight configuration is 100% and the property's current value is 100,000, the value is calculated as 100% * 100,000.This calculated value displays in the Collateral > Documents > Valuation > Field: Value.Using this value the adjusted collateral value is calculated.

Formula: Valuation * advance rate (advance rate is set as 100% by default).

Review Property Valuation: For a Bridge Loan with or without connected Loan (No Dependency rule),once the application completes “Get Property Valuation” task, this task gets created as per the below rule.

When this task is created depending on the valuation the LTV is recalculated.The Ops user reviews the property valuation details, updates the required changes to the loan and completes the task.

| Key | Value |

|---|---|

| RETAIL_BANK_BUREAU_SCORE | 400 |

| Key | Value |

|---|---|

| RETAIL_ AIP_ESIS_DOCUMENT_VALIDITY_PERIOD | 30 |

Get Score Card Values for Credit Assessment: Once the Perform Property Evaluation/Title search task gets completed,Get Score Card Values task gets triggered.The system determines the values for all the attributes mentioned in the score card for the credit assessment. This is an auto task executed by the system.

Rule: Bureau Check is completed and the Score values are stored in the database.

This auto task is created based on score card attributes and values even if a BL has connected loan or no connected loan.The task is applicable for all the parties.

Once the task gets completed, the application moves to the next task Execute Score Card for Credit Assessment.

When the System is in Get Score Card Values task, the task is automatically executed and closed.

Execute Score Card for Credit Assessment: The system carries out the following function - once the values are determined for all the attributes mentioned in the score card, overall score card is executed and based on the score card rules the final score is determined. This is an auto task executed by the system.

Refer to the detailed rules for Retail Secured Loans (Bridge Loan)- Score card and Credit Risk.

When the System is in Execute Score Card task, the task is automatically executed and closed.

Rule: Score values are retrieved as part of the get score card task and the score values are stored against the application.

Final Score value is arrived at and stored against the Request. Once the task gets completed, the application moves to the next task Execute Decision Engine Rules.

Execute Decision Engine Rules: All the Underwriting related business rules and policies configured in the system are executed by the system and results in the final approval of the application. This task is performed by the system automatically based on the rules configured, the application gets auto approved, auto declined or sent for Manual review/Under review.

- Auto approved Cases move to the next stage Offer.

- The application gets closed for auto rejected cases.

- Deviation cases move for manual review (Review Credit Decision).

Rule: Evaluate the business policies, rules and score card values to arrive at the final decision.

Once the task gets completed, the auto approved application moves to Integration to Transact task and the deviation cases moves to the Review Decision Engine Credit Decision task - Depending on the loan amount the respective user group can view / action on the application. The rejected applications are marked completed and move out of the workflow.

Decision engine task triggers automatically when the Credit Scoring task is complete.Decision engine’s outcome can be either Auto Approved, Auto Denied or Manual Review. When the Decision is auto-declined, the Decision status in Product Overview is marked as Rejected. Product stage moves to completed and is highlighted in Red. Based on the Decision outcome received the Decision engine task is automatically closed. The system automatically displays a comment “Bridge Loan is Declined as connected loan is not approved” in the Product Overview > Decision > Comment section.

Refer to the detailed rules for Retail Secured Loans (Bridge Loan)- Score card and Credit Risk.

Review Decision Engine Credit Decision: The Review Credit Decision task is created only when a manual decision is required. If the conclusion of Decision Engine is either Auto Approved or Auto Denied, the Review Credit Decision task gets closed automatically.

(By Underwriter user): If the Loan amount is < 1 million USD, then this task gets created for Mortgage Underwriter user to approver/reject. The underwriter user reviews the task which are sent for manual review and provides the decision accordingly. Underwriter claims the application/task when automatic assignment rules fails or disabled and processes the case. Clicking the task navigates the user to the Credit section under Request Overview.

Any case not processed straight through the credit rule engine, is routed to this stage for the underwriter to review the application for its merit and take decision to approve or decline accordingly.

- The decision makers at this stage have the appropriate rights.

- Approved Cases move to the next stage Offer acceptance.

- The application is marked as Completed for Rejected cases.

Task is routed to Mortgage underwriting Tasks queue, which is accessed by the Underwriter if the Loan Amount <= 1 million.

Rule: The task is created if the Product does not meet the rules for auto approval or auto decline.

Check the loan amount and route the application to this queue if the loan amount is <=1 million.

Underwriter updates the final decision after the review. Once the user completes the activities, the task is marked as completed, the application moves to the next task Integration to Transact.

Review Decision Engine Credit Decision(by Credit Approver user) : The credit approver user reviews the application having exceptions and provide the decision accordingly. The credit approver user claims the application/task when automatic assignment rules fails or disabled and processes the case. Clicking the task navigates the user to the Credit section under the Request Overview.

Manual Credit Decision - This is a manual credit decision process, performed by the Credit Approver.

Any case not processed straight through the credit rule engine, is routed to this stage for the underwriter to review the application for its merit and take decision to approve or decline accordingly.

- The decision makers at this stage have the appropriate rights.

- Approved Cases move to the next stage Offer acceptance.

- The application is marked as Completed for Rejected cases.

- Task is routed to Mortgage Underwriting Tasks if the Loan Amount > 1 million.

Rule: This task is created if the Product does not meet the rules for auto approval or auto decline.

Credit Approver updates the final decision after the review. Once the user completes the activities, the task is marked as completed, the application moves to next task Integration to Transact.

Review Credit Decision task is created only when the decision engine outcome is Under Review stage. After the Decision is taken Review Credit Decision task, Underwriter can manually close the task. If Underwriter Approves the Review Task, the underwriter can manually close the task. If Underwriter Declines the Review Task, the underwriter can manually close the task and the Decision status in Product is automatically Rejected. Product stage moves to completed and is highlighted in Red.

Review Signed Deed

When loan processing is complete and Ops user addresses the manual task, System creates Review Signed deed task.

Review Executed Documents

When the customer accepts the offer and when the status of the offer document is not Approved, System creates and assigns a review task to OPS user. After the Ops user reviews, the user manually closes the task. If the customer rejects the offer, the Ops user withdraws the application on behalf of the customer and closes the task.

Tagging Agreement document with Arrangement Account

When a user uploads the documents in any Origination journey, documents are classified and stored as Entity level documents(with entity reference) and Product level documents(with product reference) in the respective Microservices.

When the application is submitted party related documents will be updated with Party reference and Product related documents will be updated with Facility/Product reference.

Also, when the application crosses the fulfilment stage, all the entity related documents will be updated with transact customer reference and the product related documents will be updated with the Account reference from transact.

Offer Acceptance

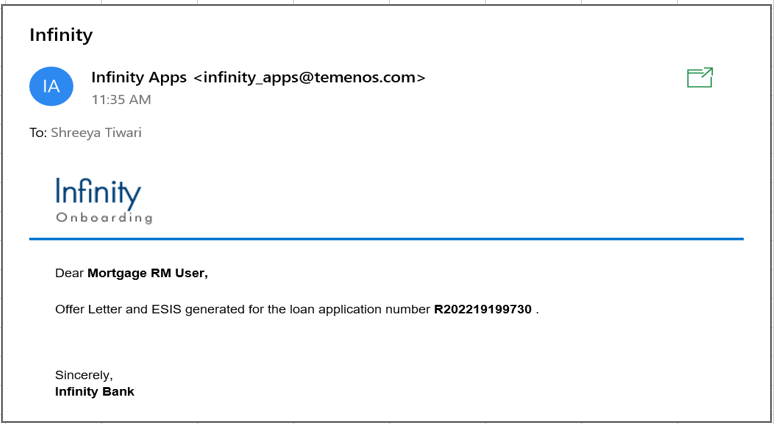

Generate Offer Letter: The Offer Document gets generated automatically as soon as the Decision is marked Approved or Auto Approved. The Offer Letter and documents is added in the document section under the Product Overview.The System sends an email notification to the customer for Offer Approval.Once the Offer document is successfully generated and an email is sent to the customer,this task gets closed automatically.

Once the integration to transact is successful, the Generate Offer Letter task is created via Formpipe. This is an auto-task and gets completed automatically after the offer letter along with all relevant documents is generated. The Offer letter is added in the documents section under the Product Overview.

In case of Multi Part applications, when the Offer Letter and ESIS document is generated through Formpipe the system adds the New Offer & its Repayment Schedule for each Mortgage Drawing Product (Part) in the ESIS document and sends the offer letter notification to the customer.

Offer letter is automatically generated once the Decision is Approved or Auto Approved. System sends an email notification to Customer along with link to download the Offer document. The task is automatically closed after the offer letter is sent to the customer.

Rule: The application has satisfied all the business policies, rules and score card values. APIs are triggered successfully and the New Offer data is received from the Transact.

Once the task is completed, the application moves to the next task Notification to RM.

When the Core banking integration happens, System updates Collateral details in Temenos Digital assist to ASSET.REG.PROPERTY table in Transact.

| ASSET.REG.PROPERTY | |

|---|---|

|

DESCRIPTION |

PROPERTY.TYPE |

|

ASSET.TYPE |

COLLATERAL TYPE |

|

ASSET.OWNER |

Main Applicant Reference |

|

OWING.PERCENTAGE |

Default 100% |

|

PLOT.NO

|

PLOT NO |

|

SIZE

|

SIZE IN SFT |

|

COUNTRY

|

COUNTRY |

|

POSTAL.CODE |

ZIPCODE |

|

VILLAGE |

|

|

TOWN

|

CITY |

|

DISTRICT

|

STATE |

|

ADDRESS

|

ADDRESS LINE 1 |

|

ADDRESS (MULTIVALUE)

|

ADDRESS LINE 2 |

|

MARKET VALUE

|

PROPERTY VALUE |

|

COEFFICIENT

|

ADVANCE RATE |

|

ADJ.MARKET.VALUE

|

ADJUSTED COLLATERAL VALUE |

|

ASSET.CURRENCY |

Facility Currency |

When the Core banking integration happens, System updates Collateral details in Temenos Digital assist to COLLATERAL table in Transact.

|

COLLATERAL |

|

|

COLLATERAL.TYPE

|

New collateral Type

|

|

NOMINAL.VALUE

|

Updated by System

|

|

EXECUTION.VALUE

|

Updated by System

|

|

COLLATERAL.CODE

|

NEW CODE

|

|

CUSTOMER APPLICATION.ID |

Main Applicant Reference ASSET.REG.PROPERTY |

After the mortgage application is approved and offer is accepted by the customer creating contract in the core banking is the done, the below products must be considered for Transact integration.

• Mortgage Seasonal

• Mortgage Cashback

After the Core banking integration happens, System updates Collateral details in Temenos Digital to COLLATERAL.RIGHT table in Transact.

|

COLLATERAL.RIGHT |

|

|

COLLATERAL.CODE

|

New Code

|

|

COMPANY

|

BNK( Defaulted)

|

|

LIMIT. REFERENCE |

Facility Arrangement ID

|

|

CUSTOMER.ID

|

Main Applicant Reference

|

|

COLLATERAL.ID |

Collateral ID |

Notification to Customer/RM :Once the offer letter is generated a notification gets triggered to the respective RM and Customer. The RM/Customer can view the offer letter / download or the RM can share it with the customer if required. This is an auto task executed by the system. When the notification is sent this task gets closed automatically.

Once the notification task gets completed, the application moves to the next task Customer actions.

Notification Template for the RM:

Notification template for the Customer:

Automatic customer action for Offer Acceptance:

Origination: The system initiates automatic customer action when the Offer document is generated. The customer action raised is used to capture the customer consent along with the Offer document. As soon as the customer action is raised an email is sent to the customer indicating a customer action is raised.

When the customer answers the customer action the system sends a mail to the RM indicating the customer has addressed the customer action.

If the customer accepts the offer, it is mandate for the user to submit the signed offer document.

If customer rejects the offer, the system allows the user to submit the customer action.

Temenos Digital Assist: When the automatic customer action is raised it displays in the Customer action summary screen which is under Customer actions Menu available in both Request and Product Overview with status updated as Pending with Customer.

When the customer answers the customer action the status is changed to complete.

Clicking the customer action in the Summary page, the RM views a link to Product Overview page where we see the Consent provided by the customer.

Customer actions - Accept/Reject Offer,Capture Disbursement and Repayment Details(Sign/e-sign): The Customer reviews the offer details based on the notification received and takes action in the origination app.

Customer marks the status as Accepted and uploads the signed Offer letter, captures the disbursal instruction and the funding details and Submits.

If the approval conditions are not satisfied, the customer rejects the offer - Captures the Reason for rejection and Submits.

Customer submits the decision in the Origination app. Once the customer provides their decision, if the offer is accepted, the task is marked as completed and the application is moved to the next task Offer Letter Acceptance/Rejection (Review Customer Action). If the customer has rejected the offer - Offer Letter Acceptance/Disbursement task is created for RM to review the customer decision and Acceptance status in PO is marked Rejected and the Offer letter document in Uploaded document section in PO is updated as Rejected and on completion of this task, the application status is marked as completed and moved out of the workflow.

Offer Letter Acceptance/Rejection (Review Customer Action): The RM updates the status of the offer in the system if the customer directly reaches the Bank for updating their decision. This is a manual task to be processed by the respective user. This task is created for both Online and offline Mode.

In case of Online mode: The customer action gets triggered for both the customer and the bank user.The customer actions submitted/actioned by the customer through assist, reviews the acceptance status - accepted/rejected, signed offer letter, etc and completes the task.

When the customer accepts the offer, the acceptance status is shown as Accepted. If the customer rejects the offer the acceptance status is shown as Rejected. If accepted, signed offer letter uploaded by customer is shown under PO > Documents > Uploaded Documents and RM to update the status of Offer Letter document as Signed, If rejected, RM should upload the Offer letter and update the status as Rejected.

Customer Action - Accept offer: If the customer accepts the offer, the dependent customer actions is raised and the customer needs to upload signed offer document ,capture disbursement and repayment details.

Customer Action - Reject offer: If the customer rejects the offer, the system allows the user to select the reason for rejection and submit the customer action.If the customer rejects the offer, no other customer actions displays.

In case of Offline mode: The RM updates the acceptance/rejection on behalf of the customer,also uploads the signed offer letter received from the customer and reviews the signed document.The task is completed by updating the offer status as accepted or rejected.

- If the offer is accepted the RM updates the customer's decision as complete.The application moves to the next stage and creates a task "Capture/Review Disbursement and Repayment Instruction".

- If the customer rejects the offer, the offer acceptance status is updated as rejected and completes the task, on completion of the task, the request is updated as completed and the workflow ends.

Once above steps are done, on completion of this task, if the offer is accepted, the next task gets created as configured in the workflow. If the offer is rejected,the application status is updated as complete.

Automatic customer action for Disbursement and Repayment Instructions:

Origination: The system initiates Automatic customer action when the Offer is accepted by the customer. The customer action raised is used to capture the Funding and repayment. As soon as the customer action is raised an email is sent to the customer indicating a customer action is raised.

When the customer answers the customer action the system sends a mail to the RM indicating the customer has addressed the customer action.

- If the customer accepts the offer, it is mandate for the user to submit the signed offer document.

- If the customer rejects the offer, the system allows the user to submit the customer action.

Temenos Digital Assist: When the automatic customer action is raised it displays in the Customer action summary screen which is under Customer actions Menu available in Request and Product Overview with status updated as Pending with Customer.

When the customer answers the customer action, the status gets changed to complete.

When Clicked customer action in the Summary page, the RM can view a link to the Product Overview page which displays the Funding details provided by the customer.

An Invited prospect Co-applicant,gets updated when the offer letter is generated and if the Primary applicant has accepted the offer letter or not.

Offer Letter Acceptance/Rejection : If Primary applicant accepts/rejects the offer in online mode, a mail is sent to the co-applicant updating the decision taken. The generated offer letter is sent to all the involved parties.

Subject - Offer Letter

"Dear Mr. <Co-applicant>,

We would like to inform you the Mr. <Primary applicant> has accepted/rejected the offer of <Facility> for <approved amount>

Regards

Temenos Digital Bank.

Due Diligence :

Capture/Review Disbursement and Repayment Instruction: The RM checks for the disbursement and repayment instruction captured in the application by customer, in the online mode.

When the status of the funding instructions is updated as approved and acceptance status is approved, the system automatically closes the task.

In case of offline mode, RM captures the disbursement and repayment details on behalf of the customer. In case of multipart, RM captures the disbursement and repayment details for all the Drawings.

This is a manual task to be processed by the respective user. Clicking the task navigates the user to the settlement section under Product Overview.

In case of Online mode, disbursement and repayment instructions customer actions are automatically triggered once the customer accepts the offer and once the customer submits disbursement and repayment details (for each Drawing), these details gets automatically added in the Funding Section of Product Overview. We have defaulted the status of the funding instructions captured by customer to be updated as Approved, so records will be shown as approved once submitted by customer. Hence for Online mode, this task gets auto closed.

If the status is not approved, the RM can capture the information as required.

The task is in the Mortgage Processing Tasks queue.

Rule: Offer Accepted and the disbursement instructions are pending.

Incase of multipart application, the disbursements and repayment is shown in the respective Drawing Overview and Drawing Screen.

Once the user completes the activities, the task is marked as completed, the application moves to next task Capture Notary Comments.

Capture Notary Comments:

When the bank user is in the Due Diligence Stage and when RM completes the Review Disbursement instruction task, System creates Capture Notary comments task.

As a part of the OPS team, the user updates the feedback given by the Notary Officer. This is a manual task to be processed by the respective user.

When the Review Disbursement instructions task is completed by the RM and if the acceptance status is approved the system creates the Capture Notary comments task.

After the RM captures/reviews the disbursement and repayment instructions, the task gets created in Mortgage Settlement Tasks Queues. Clicking the task navigates the user to the Notary --> Settlement section under Product Overview.

The Ops user claims this task and captures the Notary comments, status and date of execution of deeds. The task is in the Mortgage Settlement Tasks Queues queue.

Rule: Offer Accepted and the Disbursement / Repayment instructions are Captured/Approved.

Once the user completes the activities, the task is marked as completed, the application moves to the next task Review Executed Documents.

The Following fields & functionality are included:

Add Notary Button: Clicking the add notary button displays the following fields for the user to capture the details:

- Notary Name

- Date of Deed

- Comment

- Status of Deed

After capturing the details user clicks update to save the record. Click Cancel to cancel the action and return back to the previous screen.

- If the notary information comes from an external source (any third party application via integration), a record is added automatically , if the integration is available.

- Edit Notary :The captured details are editable by clicking the add notary option.

- View Notary : The details captured can be viewed by clicking the view option.

- Delete Notary: Using this option the user can delete the notary details record that is created. This is provided as a restricted option to a certain user groups only.

- User permission: The respective access rights / permissions based on the user role is configured in the system.

When Disbursement Instruction to be provided by Notary? is selected as Yes, then customer action is marked as completed.

- Disbursement record must not be added in the funding section in Assist.

- Repayment Instruction record must be added in Additional Instruction section in Assist.

- Capture/Review Disbursement and Repayment Instruction is created for Mortgage RM user.

When Disbursement Instruction to be provided by Notary? is selected as No, then customer action is marked as completed in Assist (Request Overview/Product Overview screen)

- Disbursement record is added in the funding section in Assist (Product Overview /Drawing Overview screen).

- Repayment Instruction record is added in Additional Instruction section in Assist.

- Capture/Review Disbursement and Repayment Instruction is created for Mortgage RM user.

Review Connected Loan: When the Capture Notary Comments Task gets completed, this task gets created before moving the loan to closing stage.This rule is checked in both the connected flows (Mortgage/Remortgage Loan and Bridge Loan).Clicking this task navigates the user to the Product Overview -> Connected Loan section.

The Ops user manually reviews the connected loan and completes this task only if this customer agrees to proceed with both the connected loans.This is a manual task processed by the respective user.

Once the user completes the activities,the task gets completed and the application moves to the Closing stage and creates the next task "Review Executed Documents".

Closing :

Review Executed Documents: Once the Offer Letter Acceptance & Documents Upload task are completed, the OPS user completes the document execution, for this activity a Review Executed Documents task is created. This is a manual task to be processed by the respective user. Clicking the task navigates the user to the Document section under Product Overview. Through this task, the Operations user reviews the signed the Offer Letter Document and updates the status of the document as Approved. The task is in the Mortgage Settlement Tasks Queues queue.

Rule: Offer Accepted, disbursement / repayment instructions are approved. Notary feedback is also captured.

Once the user completes the activities, the task is marked as completed, the application moves to next task Fulfilments.

The system auto closes the Review Documents task when the offer document and acceptance status is approved.

When Bank User closes a task manually, without completing all the required steps, then System completes the task and displays a loading or processing icon marking that Task completion is unsuccessful. Pop-up notification will have a link which when clicked redirects to the task dashboard. The newly created task will be re-assigned to the same user. The task in the footer will be highlighted in RED.

Fulfilments (Integration with Core system for Customer, Account, Limit, Collateral creation, Disbursement) : On completion of the Executed Documents Review task, an auto task must be created to create the Limit/Arrangement in T24 or Core Banking System (CBS) only if the requested Product is a Mortgage Loan. This task gets completed automatically after Limit/Arrangement creation is complete in T24 or CBS.

All the fulfillment details are sent to transact through the respective transact APIs. After the successful transact integration and validation of fulfillment data,the Bridge Loan Arrangement Account ID gets created and displays in the Product Overview screen.The Collateral is created/updated in the transact.

After completion of the fulfillment, a notification is sent to the customer and the RM.The request is moved from the closing stage to the Follow-up stage creating next task in the workflow.

- When the Funding Instructions task is closed the system automatically triggers the fulfillment task.

- Once the fulfillment completes, the loan account and disbursed task is closed automatically.

System triggers the Live / Arrangement creation API.

Rule: Application is Approved and the documents are reviewed and fulfilled.

When the Funding Instructions task is complete, System triggers the fulfilment tasks automatically. Once the fulfilment is complete and the loan account is created and Disbursed. System automatically marks the task as complete.

Loan Completion - Notify Customer/RM:Once the arrangement Id is created successfully,a notification is sent to the customer and the RM.

Rule: Bridge Loan Arrangement successfully created in transact.

Notification Template:

Congratulations <Entity Name> <Product Name!>

Your application has been approved.

User Name: XXXXXX.

Application Number: XXXXXXX.

Created on : DD MMM YYYY

There is so much to explore in your new Temenos Digital account.

Use the Activation Code we sent to your mobile device to start your online experience here or try our Temenos Digital apps for Apple and Android.

Sincerely,

Temenos Digital Bank.

Follow-up

Review Document & Deed Signed: Once the arrangement Id is created successfully,a notification is sent and the application moves to the Follow-up stage. This is a manual task that needs to be created.The Ops user reviews the legal,property document and signed deed.After successful completion of this task the request status is updated as complete.

Complete Task:When the user completes each manual task by clicking the complete option in the respective workflows - Mortgage, First Time Buyer, Remortgage and Bridge Loan, the system displays the message “Task completion successful” message to the user and navigates the user back to the Task overview page.

User management and permissions

Below is the image of the tasks associated to the Users.

Creation of User Roles: The Bank's IT Administrator User is responsible for creating the user roles and providing access rights to users in the System. This is a manual task to be processed by the respective user. The following user roles are created in the system:

- Mortgage RM

- Mortgage RM Supervisor

- Mortgage UW

- Mortgage Credit Approver

- Mortgage Ops

- Mortgage Supervisor

Refer to the attached excel Bridge Loan_User_Management Latest for user access management for this screen. User Permissions is setup as per the permissions mentioned in the excel.

Notification Configuration: Configuration of below mentioned notification features are available in the system. This is a manual task to be processed by the respective IT administrator user.

- Notification Modes are created in the system. Option to select the Notification type is available for all automatic notification triggers.

- SMS

- Both

- The message format or the templates for SMS and Email is configurable by the Bank team and is able to edit the same if required.

- Trigger Event: In-Principal Approval, Offer Letter & ESIS generation, Loan Completion etc.

- Notify to Recipients

- Customer - Main Borrower or

- Customer - All Parties or

- RM or All

Score Card and Rules Sheet:The configuration done for the score card, the application data is evaluated to appear at the final score.The final arrived is used for “auto approval” or “auto decline” or “manual decisions”.

Please refer to the link for Score Card and Rules Sheet.

Please refer to the attached excel for application and task level - queues/escalation queues.

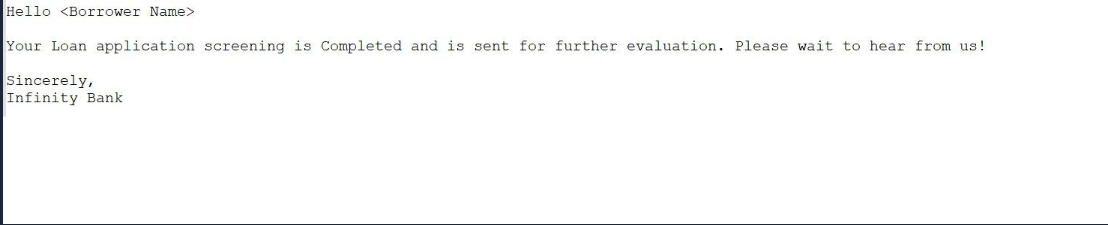

Notification Configuration -Prescreening -Notification Template:

Email Notification Message Content and Template: Pre screening-Notification

SMS Notification Message Content and Template: Pre screening-Notification

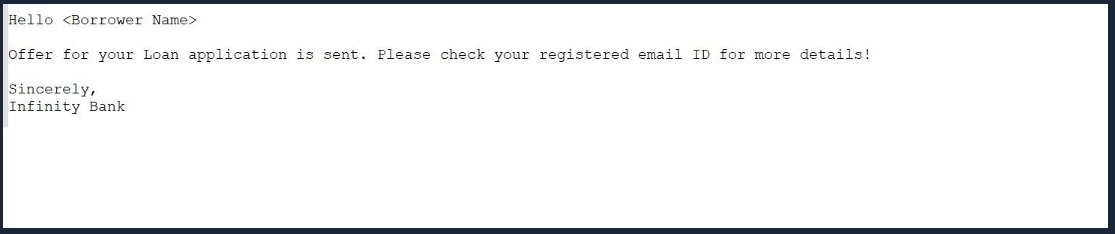

Notification Configuration - Generate Offer Letter - Notification Template :

Notification Message Content and Template: Generate Offer Letter - Notification

SMS Notification Message Content and Template: Generate Offer Letter - Notification

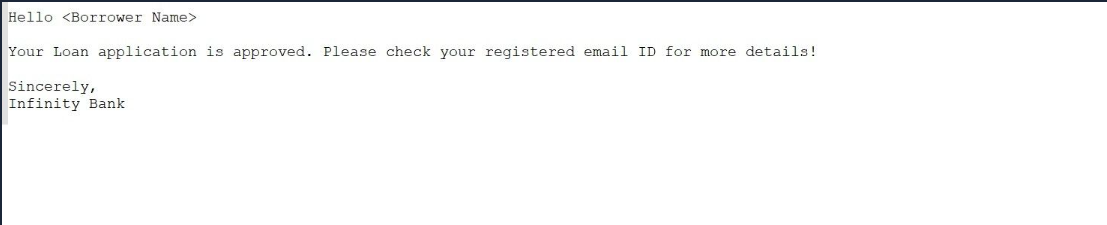

Notification Configuration-Loan Approved - Notification Template :

Notification Message Content and Template: Loan Approved - Notification

SMS Notification Message Content and Template: Loan Approved - Notification

Please refer to the link for information regarding Bridge Loan - Stages and tasks with queue.

The following features are applicable to all user roles in the solution who are assigned a task to work on.

In this topic